How to Choose a Medicare Supplement Plan?

Choosing a Medicare supplement plan depends on your personal preferences, health needs, and budget. Here are some factors to consider when comparing plans:

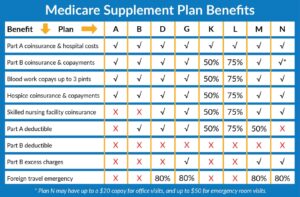

- Coverage: Compare the benefits offered by each plan type and decide which ones are most important to you. For example, if you travel frequently, you may want a plan that covers foreign travel emergency. If you have high medical expenses, you may want a plan that covers Part B excess charges.

- Cost: Compare the premiums, deductibles, coinsurance, and copayments of each plan type and decide how much you can afford to pay. For example, if you want to save on premiums, you may choose a high-deductible plan or a plan that covers less benefits. However, you may have to pay more out-of-pocket costs when you use health care services.

- Availability: Not all plans are available in all states or areas. You may also have to meet certain eligibility criteria to enroll in a plan. For example, you must be enrolled in Medicare Part A and Part B, and you must live in the plan’s service area. You may also have to apply during certain enrollment periods, such as when you first become eligible for Medicare or during the annual open enrollment period. Some plans may also require medical underwriting, which means they can reject you or charge you more based on your health status, unless you have a guaranteed issue right.

- Quality: Compare the ratings, reviews, and customer service of the insurance companies that offer the plans you are interested in. You may want to choose a company that has a good reputation, a high financial rating, and a responsive and helpful customer service.

Where to Find More Information?

If you want to learn more about Medicare supplement plans, you can visit the following websites:

- Medicare.gov: The official U.S. government site for Medicare, where you can find general information, compare plans, and enroll in a plan online.

- State Health Insurance Assistance Programs (SHIPs): A network of free counseling services that can help you with Medicare-related questions and issues.

- Medicare Rights Center: A nonprofit organization that provides education, advocacy, and assistance for people with Medicare.

Medicare supplement plans can help you pay for some of the health care costs that Medicare does not cover. However, they are not the only option available to you. You may also want to consider Medicare Advantage plans, which are another way to get Medicare benefits through private insurance companies.