By C.J. Trent-Gurbuz

This article is based on reporting that features expert sources.

In this article, we’ll go through the basics of what IRMAA entails and who might qualify for this additional fee.

Medicare can be a complex web, and untangling its various strands to ensure you’re getting the most appropriate coverage can be daunting. One thread you might find yourself unsnarling is income-related monthly adjustment amounts, or IRMAA.

What Is IRMAA?

Medicare IRMAA is an income-based surcharge that couples or individuals must pay on top of existing premiums for Medicare Part B (coverage for preventive care, doctor visits and outpatient care) and Medicare Part D (prescription drug coverage).

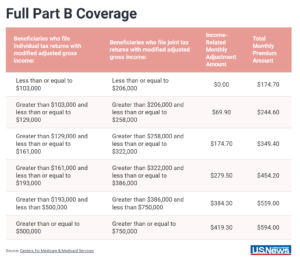

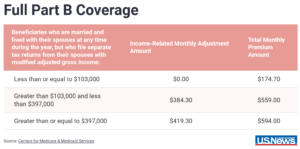

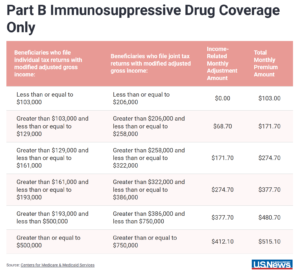

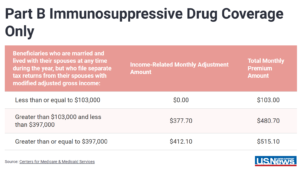

IRMAA is based on your modified adjusted gross income, also referred to as MAGI, from your tax filings two years prior to your enrollment date. For example, you would qualify for IRMAA in 2024 if your MAGI from your 2022 tax returns meets the 2024 income thresholds ($103,000 for beneficiaries who file individual tax returns and $206,000 for those who file joint tax returns), according to the Centers for Medicare & Medicaid.

“I call it the Robin Hood theory because the government takes from the rich, but instead of giving it to the poor, they just use it to fund the Medicare trust fund,” says Darren Hotton, associate director of community health and benefits at the National Council on Aging, based in the Washington, D.C., area.

Who pays IRMAA fees?

Only those enrolled in Medicare Parts B and D need to pay IRMAA fees. If you’re enrolled in Part A (hospital, skilled nursing facility and other inpatient coverage), IRMAA doesn’t apply.

Do IRMAA fees apply if I have Medicare Advantage?

Medicare Advantage, also known as Part C, differs from Medicare Parts A and B. Known as “original Medicare,” Parts A and B are government-funded. With Medicare Advantage, government-approved private insurance companies provide comparable coverage.

If you’re enrolled in Medicare Advantage, you are still required to pay for Medicare Part B. If you qualify for IRMAA, then you’re paying:

- The monthly Part B premium.

- The IRMAA fee.

- The Medicare Advantage plan’s monthly premium.

IRMAA also applies if you’re enrolled in Medicare Part D, which is the separate drug prescription plan, though some Medicare Advantage plans fold in prescription coverage. If you’re enrolled in Part D in addition to your Medicare Advantage plan, you’ll pay:

- The monthly Part D premium.

- The IRMAA fee.

- The Medicare Advantage plan’s monthly premium.

IRMAA Changes for 2024

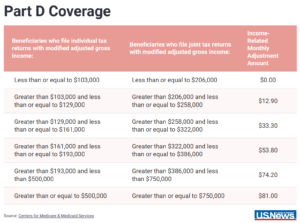

For 2024, Medicare has adjusted the thresholds for IRMAA. They are:

Navigating IRMAA: Important Considerations

Qualifying for IRMAA one year doesn’t mean you’ll qualify every year.

“The (IRMAA) amount is now indexed for inflation, which means that it will be going up every year. If you’re near the threshold now and your income isn’t going to increase significantly, there’s a chance it might apply to you now but not next year,” explains David Lipschutz, associate director at the Center for Medicare Advocacy, based in Washington, D.C.

Life-changing events – such as divorce, death of a spouse or changes in employment – are also an important factor. If you sold a large property and received a boost in income, you might have to pay IRMAA for a specific period of time, Hotton adds. Once that timeline ends and your tax records indicate your income went back to its regular amount, you might not qualify for IRMAA.

How will I know if IRMAA fees apply?

You’ll receive a letter in the mail to notify you.

The IRS sends your tax returns to the Social Security Administration, which then conducts an assessment. If you qualify for IRMAA, Social Security will send you information on what your premium will be starting in January of the next year. Usually, Hotton says, these letters arrive in November.

“Everybody who is part of IRMAA or who has to pay that additional premium has to be notified every year at the end of the year about what their premium will be for the next year,” Hotton explains.

How are IRMAA fees paid?

You can pay IRMAA fees in a few different ways.

For most people, IRMAA fees are added to your premium, which is taken out of your Social Security check.

If those fees aren’t taken out of your Social Security benefits, you may receive a bill in the mail. You can then pay your fees:

- Through Medicare’s Easy Pay program.

- Online through your bank.

- With automatic deductions from your bank account.

- By mailing your payment to Medicare every month.

IRMAA appeals process

If you think you’ve qualified for IRMAA in error, you can appeal.

“Every time someone comes to me, I always tell them to appeal,” Hotton says. “It doesn’t hurt to try.”

There are justifications for an appeal, though your chances of being successful depend on your individual circumstances, Lipschutz adds.

Those justifications can include:

- A life-changing event.

- The IRS has outdated or inaccurate information they used to determine your eligibility for IRMAA.

You’ll need to submit documentation, such as an amended tax return, to Social Security and fill out a reconsideration request form.

“If you have information to refute what (the IRS and Social Security) are saying, that’s your money and you shouldn’t have to pay this additional premium just because the government tells you to,” Hotton says. “You should always appeal it and see what they’re saying, provide the information you think you have to provide to them and then wait for the decision.”

CMS notes that the initial determination notices you receive the mail will also contain information on how to appeal and contact the Social Security Administration.

How Does IRMAA Affect Social Security Benefits?

IRMAA does affect your Social Security benefits, but in one specific way: Because Part B premiums are deducted from your Social Security benefits, and IRMAA attaches to and boosts those premiums, higher amounts are taken out of your Social Security check.

IRMAA does not affect your right to Social Security, Lipschutz emphasizes. It only affects the total amount you receive each month.

CMS also notes that the hold-harmless provision, which limits Social Security benefit reduction due to Medicare premium increases, does not apply to beneficiaries who are required to pay IRMAA.

The Bottom Line

IRMAA may not be a constant for all Medicare enrollees, so keep in mind that your status can change from year to year.

If you do qualify for IRMAA, attention to detail is key: Make sure your paperwork is in order and correct, and don’t be afraid to ask questions. After all, it’s your money, time and effort that you’ve put away for retirement, so it’s important to advocate for yourself, Hotton says.

“Fight the good fight,” he adds, “because that’s what (appeals are) for.”